In school, we learned that to take the average of something, you take the sum and divide by the number of items.

This is called the simple average. For some things, this works well enough.

But when it comes to managing your investments, knowing the simple average isn’t enough.

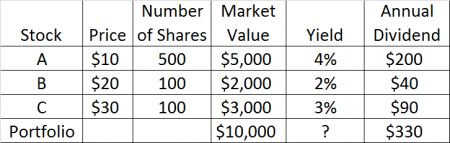

Take a look at the following table.

The table shows Joe’s $10,000 stock portfolio. He has three stocks. Stock A yields 4%, Stock B 2%, and Stock C 3%. What is the portfolio’s dividend yield?

If you take the simple average, you would just add 4%, 2%, and 3% together and then divide by 3.

The answer is 3%!?

But that’s wrong.

The Proper Way to Do It

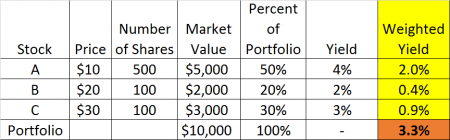

As you can see in the Annual Dividend column, John actually gets $330 in dividend a year ($200 + $40 + $90), so his portfolio’s current yield is actually 3.3% ($330 ÷ $10,000)!

The simple average does not work because the three stocks are not equally weighted. In real life, a real-money portfolio is almost never truly equally weighted, because stock prices move and change the market value.

The simple average does not work because the three stocks are not equally weighted. In real life, a real-money portfolio is almost never truly equally weighted, because stock prices move and change the market value.

To properly calculate the portfolio’s yield, you have to take into account the different weight of each position in the portfolio. This is where weighted average comes in.

Let’s go back to our example.

For each stock position, you must calculate its percentage of the portfolio, and then multiply that percentage by the yield.

Therefore, to calculate the weighted yield for Stock A, you multiply 50% by 2% to get 2%. Repeat the process for B and C.

After that’s done, you just have to take the sum of all the weighted dividend yields of each stock to get the weighted average yield of the portfolio.

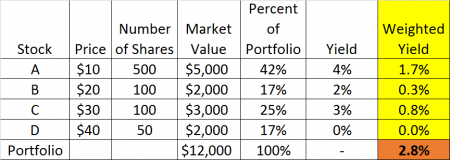

What About Stocks That Don’t Pay a Dividend?

Don’t forget to include the stocks that don’t pay a dividend in the calculation. After all, they are also part of your portfolio!

Let’s change our example a little bit and add a Stock D that doesn’t pay any dividend. The same method still works.

Nowadays, online brokers usually have a button you can click to export your account summary into a spreadsheet (such as Excel).

For each position, the account summary should already display the percentage weighting and the yield, so you just have to multiply the two numbers together and then add them up for all the positions.

The weighted average calculation method is not rocket science, but it is a useful tool that comes in handy when it comes to investments. Besides the dividend yield, if you want to figure out your portfolio’s return or the interest rate you are paying on a group of loans, taking the weighted average works.

Knowing how to accurately calculate the weighted average enables you to better manage your portfolio. After all, if you don’t have a clear picture of your portfolio’s characteristics, it’s harder to steer.

Editor’s Note: Investing Daily’s Scott Chan just provided you with timeless investing tools that work even in difficult conditions.

If you’re looking for money-making advice that can weather any storm, turn to our colleague Jim Fink.

As the chief investment strategist of Velocity Trader, Jim has perfected certain investing methods that reap profits in up or down markets…even when the markets are a roller coaster, such as we’re experiencing lately.

During a forthcoming free event, Jim Fink will explain how his scientific investing system pinpoints stock movements as small as 1%, before they happen, and then leverages those movements for whopping gains.

Jim already has used his system to deliver 20,747% profits to a small group of Investing Daily readers in less than five years.

To learn Jim’s secrets, secure your place on this special event. But you’d better act now. Spots are limited and they’re going fast. Click here to sign up.