Bitcoin prices experienced relative malaise in December as volatility remained low.

Getty

Bitcoin’s price volatility was fairly low last month, as many traders awaited the latest news surrounding key considerations like central bank digital currencies (CBDCs).

China, in particular, has been drawing substantial attention, as many have been eagerly awaiting the digital yuan it plans to issue.

The relative malaise experienced by bitcoin markets took place as the cryptocurrency struggled with lackluster sentiment, said analysts.

[Ed note: Investing in cryptocoins or tokens is highly speculative and the market is largely unregulated. Anyone considering it should be prepared to lose their entire investment.]

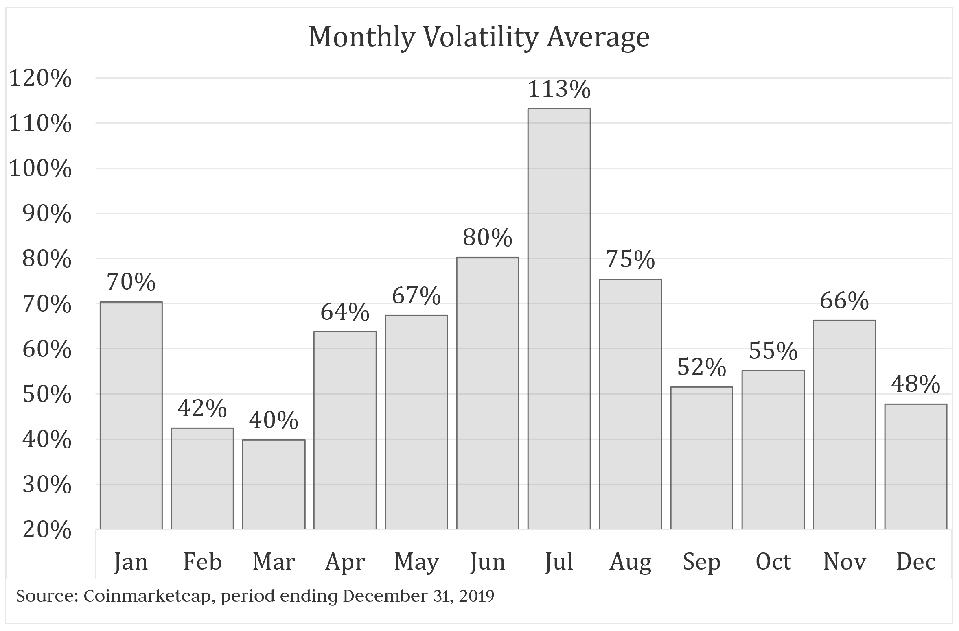

In December, the digital currency’s average monthly volatility reached its lowest since March, according to data provided by independent cryptocurrency analyst David Martin.

Further, “bitcoin’s average volatility for the month of December (48%) was significantly below the yearly average of 65%,” he added.

The chart below helps show this volatility:

This shows bitcoin's 30-day volatility (by month) for 2019.

David Martin

The digital currency also experienced lackluster trading volume, a development emphasized by Mati Greenspan, founder of the newsletter Quantum Economics.

“Throughout the month, bitcoin traded in a very tight range and on low volume. It did threaten to dip lower several times but managed to hold ground, possibly indicating that a bottom is in sight.”

Bitcoin Trading Largely Range-Bound

Amid these market factors, the cryptocurrency spent most of December fluctuating between $7,000 and $8,000, CoinDesk data shows.

Bitcoin experienced some notable price volatility early in the month, surging to an intra-month high of nearly $7,800 on December 4th, additional CoinDesk figures reveal.

Roughly two weeks later, on December 18th, the digital currency fell to nearly $6,400, its lowest point of the month.

The cryptocurrency quickly recovered, a development that took place when bitcoin experienced strong support, said Jeff Dorman, chief investment officer of asset manager Arca.

Bitcoin prices rallied largely because buyers drew a “line in the sand,” he stated.

“The general consensus was that the market would go lower near-term, but move substantially higher longer-term (as seen throughout December in the options curve with positive 1-month skew but very negative 3- and 6-month skew, and much higher volatility in the longer-dated options),” added Dorman.

“This positioning meant that it was pretty easy for the market to move higher once real-money buying stepped in.”

After experiencing this rebound close to mid-month, the digital currency spent most of December’s remainder moving between $7,000 and $7,500.

Central Banks Steal The Spotlight

Central banks around the world have been drawing the interest of investors, traders and cryptocurrency enthusiasts who want to see the progress these financial institutions are making toward issuing fiat digital currencies.

The People’s Bank of China (PBOC), in particular, has been generating visibility as industry participants wait for it to issue its fiat digital currency, called digital currency electronic payment (DCEP).

Last month, reports surfaced indicating that the PBOC planned to test out DCEP by holding pilots in cities including Suzhou and Shenzhen. The idea was to hold trials using the digital fiat currency for real-world applications, according to CoinDesk.

China is not alone in working towards the use of CBDC, as many central banks have been working toward releasing such digital assets.

CBDCs have taken center stage, as a decision by a major economy to implement a fiat digital currency would be a major endorsement for the entire crypto space.

Further, such a move could provide significant improvements for our financial system.

“CBDCs are a reaction to the rise of cryptocurrencies and the realisation by central banks that existing payment rails for fiat currencies are slow, inefficient and technologically outdated, and that the private sector alone may not be able to fix this,” said Nic Niedermowwe, cofounder & CEO of Prime Factor Capital.

“In addition, some countries such as China may see CBDC as an opportunity to spread the use of their currency beyond national borders in order to gain political and economic influence,” he stated.

“An example would be the ability to sanction other countries by cutting them off from access to a payment system they have come to rely on, or conversely by offering them an alternative access to the international financial system.”

Lackluster Sentiment

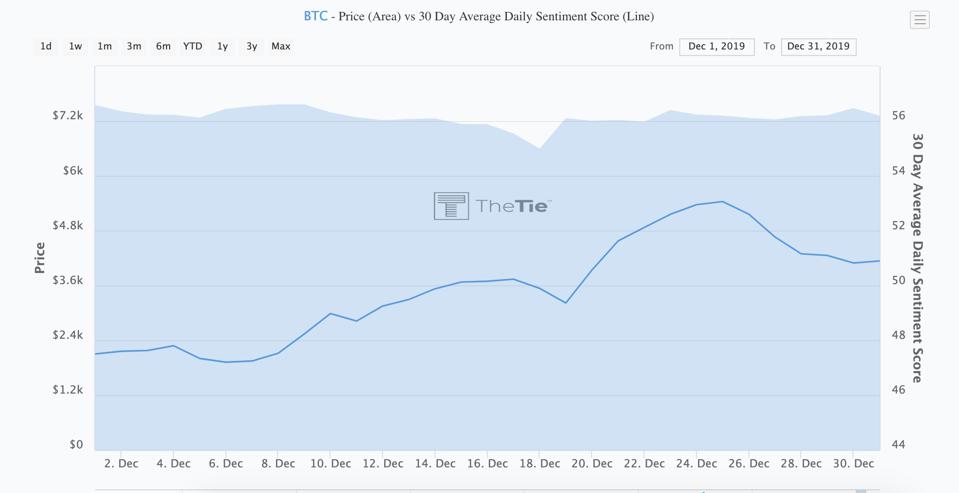

The sentiment of bitcoin traders was relatively mild in December, according to data provided by digital analytics platform TheTIE.io.

During the month, the cryptocurrency’s 30-day average daily sentiment score changed little, starting the month out with a value slightly below 50 (average) and finishing the period at roughly 51.

This chart depicts bitcoin’s price movements and sentiment in December:

Bitcoin price versus its 30-day average daily sentiment.

The TIE

While the figures supplied by TheTIE.io made sentiment appear lukewarm, Dorman took a different tack.

He maintained that “negative sentiment in Asia” has been “weighing on Bitcoin” during the month, as “we’ve seen a lot more selling pressure during Asian hours than US hours.”

As central banks around the world make progress toward rolling out digital fiat currencies and the broader digital currency space continues to evolve, sentiment could very well improve, helping place upward pressure on asset prices.

Disclosure: I own some bitcoin, bitcoin cash, litecoin, ether and EOS.